In 2024, the global smartphone market experienced a recovery, with shipments growing by approximately 7% to reach around 1.22 billion units, according to Canalys. Amidst this, Xiaomi, founded in 2010 by Lei Jun and others, captured a significant portion, with estimates suggesting that one in every seven mobile phones sold globally was a Xiaomi device. This translates to roughly 14% market share, based on various industry reports, though figures vary slightly between sources like Counterpoint (14%), Canalys (13.8%), and IDC (13.6%). This article delves into the factors behind this achievement, Xiaomi’s current standing, and future prospects, while also considering their recent software innovations like HyperOS 2 and HyperAI.

Background on Xiaomi

Xiaomi started as a smartphone manufacturer, known for high specifications at competitive prices, leveraging its MIUI custom Android skin, now evolved into HyperOS. Over the years, it expanded into a diverse ecosystem, including tablets, smart TVs, wearables, and smart home devices. This diversification has been crucial in building a loyal customer base, particularly in emerging markets where affordability is key. By 2024, Xiaomi had established itself as the third-largest smartphone vendor globally, trailing Apple and Samsung, with a strong presence in regions like India, Latin America, and Southeast Asia.

Factors Contributing to Xiaomi’s 14% Market Share

Several strategic elements have driven Xiaomi’s success, aligning with the claim of one in seven phones sold being a Xiaomi:

- Competitive Pricing Strategy:

Xiaomi’s pricing model, offering devices from budget to premium, has been pivotal. For instance, models like the Redmi series and Poco line cater to price-sensitive consumers, while the Xiaomi 15 Ultra targets the high end. This approach has helped them capture significant market share in emerging economies, where cost is a major factor. - Product Diversity and Ecosystem:

Beyond smartphones, Xiaomi’s ecosystem includes wearables like the Xiaomi Watch S4 and smart home devices, creating a seamless user experience. This ecosystem lock-in encourages customers to stay within the Xiaomi platform, boosting overall sales. Recent promotional materials highlight HyperOS 2 with the tagline “Faster. Smarter. Smoother,” suggesting enhanced integration across devices. - Strong Presence in Emerging Markets:

Xiaomi has aggressively expanded into markets like India, where it holds a significant share, and Latin America, with a reported 18% share in Q3 2023. Their focus on these regions, where demand for affordable 5G phones is high, has been a major growth driver. For example, in Asia, Xiaomi accounted for 14% market share in Q1 2024, per Statista. - Software and AI Innovation:

The introduction of HyperOS 2 and HyperAI, as seen in recent graphics, underscores Xiaomi’s investment in software. HyperOS 2, based on Android 15, promises performance improvements, while HyperAI likely integrates advanced AI features, enhancing functionalities like fitness tracking and smart home control. This innovation likely contributed to their appeal, especially in tech-savvy markets. - Effective Marketing and Distribution:

Xiaomi’s marketing strategies, including influencer partnerships and aggressive online advertising, have built brand awareness. Their distribution through e-commerce platforms like Flipkart in India and AliExpress globally has ensured accessibility, further boosting sales.

Current Market Position in 2024

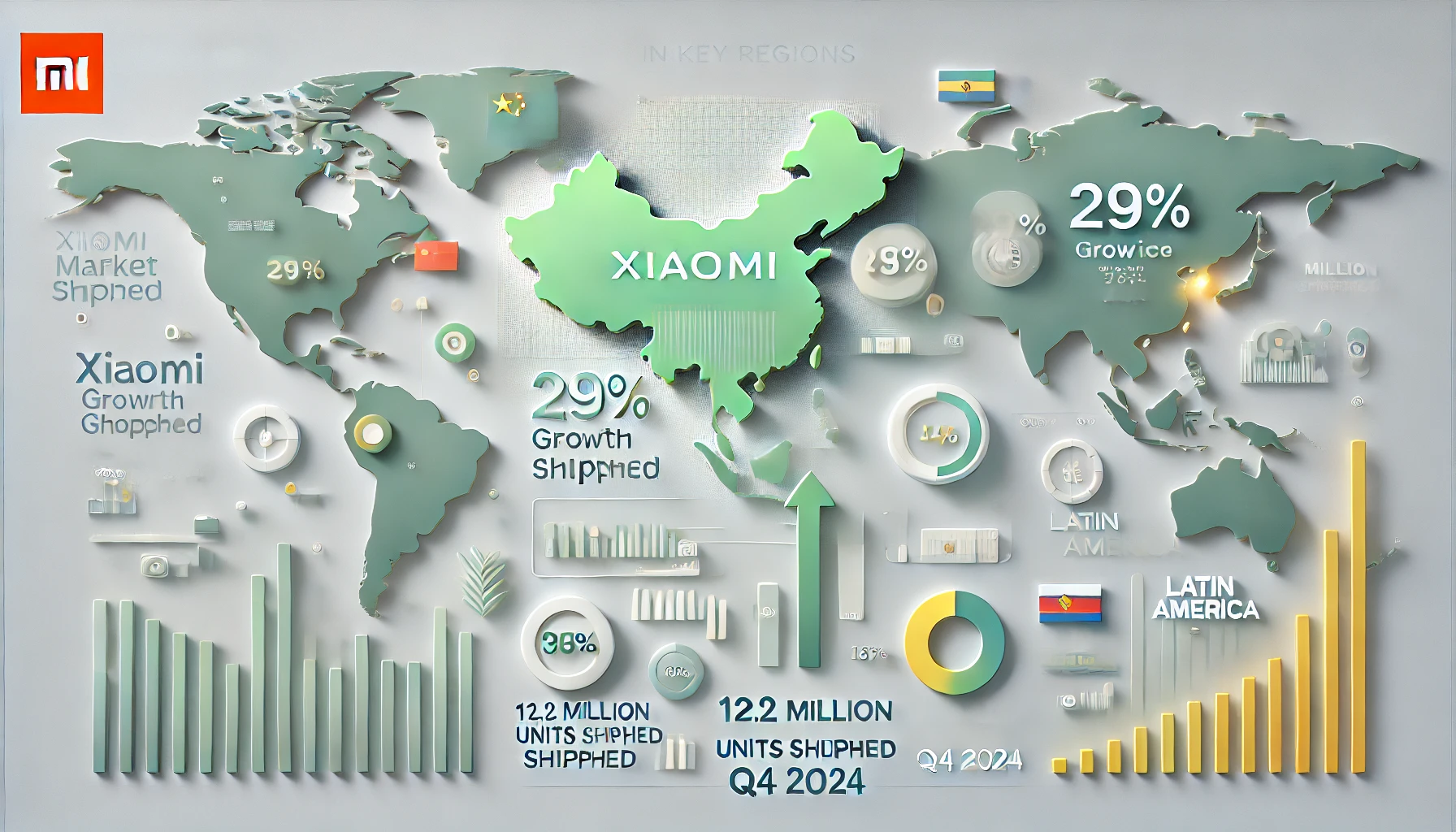

In 2024, Xiaomi’s shipments grew by 15% to 168.6 million units, according to Canalys, placing them third behind Apple (225.9 million units) and Samsung (222.9 million units). Counterpoint reports a 14% market share, while IDC pegs it at 13.6%, suggesting the one-in-seven claim (14.28%) is a rounded figure. This growth was driven by strong momentum in China, where Xiaomi achieved four consecutive quarters of market share growth, and continued expansion into emerging markets. Notably, their focus on AI-driven devices, replacing foldables as a market trend, has helped, per IDC’s research director Anthony Scarsella.

Regional Insights

- China:

Xiaomi saw a 29% annual growth in Q4 2024, shipping 12.2 million units, per Canalys, benefiting from domestic competition and seasonal promotions. - Asia:

In Q1 2024, Xiaomi held a 14% market share, per Statista, driven by strong shipments in the Middle East, Africa, and Latin America. - Latin America:

By Q3 2023, Xiaomi’s volume growth reached 18%, with 5.8 million unit shipments, per Coolest-Gadgets, indicating sustained momentum.

Future Outlook and Challenges

Looking ahead, Xiaomi is well-positioned to maintain or increase its market share, especially with the global rollout of HyperOS 2 and HyperAI in 2025, as hinted at in recent announcements. Their focus on innovation, particularly in software and AI, will be crucial. However, challenges include intense competition from other Chinese brands like Vivo and Oppo, and established players like Apple and Samsung, who are also investing in AI. Maintaining their pricing strategy while scaling production will be key, especially as Bill of Materials costs rise, per Canalys.

Conclusion

Xiaomi’s achievement of capturing approximately one in seven mobile phones sold globally in 2024, with a market share around 14%, highlights their strategic prowess. Driven by competitive pricing, ecosystem integration, and a strong presence in emerging markets, coupled with software innovations like HyperOS 2 and HyperAI, Xiaomi is a force to reckon with. As they navigate future challenges, their ability to innovate and expand will determine if they can maintain this momentum.